Fax Tax Documents to the IRS Online

Send IRS forms like SS-4, 2848, 8821, and 2553 without a fax machine. No account or subscription required. You pay only if delivery succeeds, and we retry up to 3 times if the line is busy.

When Faxing IRS Documents Makes Sense

The IRS accepts or requires fax for many forms and documents, especially when:

- You need to apply for an EIN (Form SS-4) and want it in 4 days instead of 4 weeks

- You're authorizing a CPA or attorney to represent you (Form 2848)

- You're electing S Corporation status and the deadline is approaching (Form 2553)

- You received an audit notice or IRS letter with a 30-day deadline

- The IRS agent assigned to your case requests documents by fax

Common IRS forms people fax:

Important: You cannot fax Form 1040 tax returns to the IRS. Tax returns must be filed electronically (e-file) or by mail. However, many other IRS forms and supporting documents CAN be faxed.

Common IRS Forms You Can Fax

Each IRS form has specific fax numbers. Here are the most common ones:

| Form | Purpose | Fax Number | Processing |

|---|---|---|---|

| Form SS-4 | Apply for EIN | 855-641-6935 (domestic) | 4 business days |

| Form 2848 | Power of Attorney | 855-214-7519 (East) / 855-214-7522 (West) | 3-5 business days |

| Form 8821 | Tax Info Authorization | 855-214-7522 | 3-5 business days |

| Form 2553 | S Corporation Election | 855-270-4081 (East) / 855-214-7520 (West) | Up to 60 days |

| Form 4506-T | Request Tax Transcript | Varies by state (see IRS.gov) | 10 business days |

| Form 8806 | Acquisition of Control | 844-249-6232 | Fax only |

Note: IRS fax numbers can change. Always verify the current number on the official form instructions at IRS.gov before sending.

Before You Fax Your IRS Documents

To avoid delays and ensure your documents are processed correctly:

Verify fax is accepted for your form

- • Check the form instructions at IRS.gov

- • Some forms like 8806 are fax-only; others like 1040 cannot be faxed

Confirm the correct fax number

- • Fax numbers vary by form type and your state/region

- • Use the number from the current form instructions, not old paperwork

Sign forms with wet ink (where required)

- • Forms 2848 and 8821 require handwritten signatures when faxed

- • Digital signatures are not accepted for fax/mail submissions

Include your return fax number (if applicable)

- • For Form SS-4, include your fax number to receive your EIN

- • OneFaxNow does not provide incoming fax numbers

Note: OneFaxNow is a fax delivery service, not a tax or legal advisor. Always follow the official IRS form instructions.

How to Fax IRS Documents with OneFaxNow

Prepare your IRS form or document

- • Complete the IRS form per instructions

- • Sign with wet ink where required

- • Export or scan to a clear PDF, or upload as DOCX, TXT, JPG/JPEG, PNG, or TIF/TIFF

Upload your document

- • Go to Pay-Per-Fax and upload your IRS form

- • Multiple pages merge into a single fax

- • Limits: up to 20 MB per file and 50 pages total

Add a cover page (recommended)

Include your name, last 4 digits of SSN (not full SSN), the form name/number, and reason for submission. OneFaxNow can generate one, or upload your own.

Enter the IRS fax number

Enter the toll-free IRS fax number from the form instructions. We support all U.S. toll-free and local fax numbers.

Pay only if delivery succeeds

Pricing: $3.50 for 1–10 pages and $5.00 for 11–50 pages.

Your card is authorized at checkout. We capture only if delivery succeeds. If all retries fail, you pay $0.

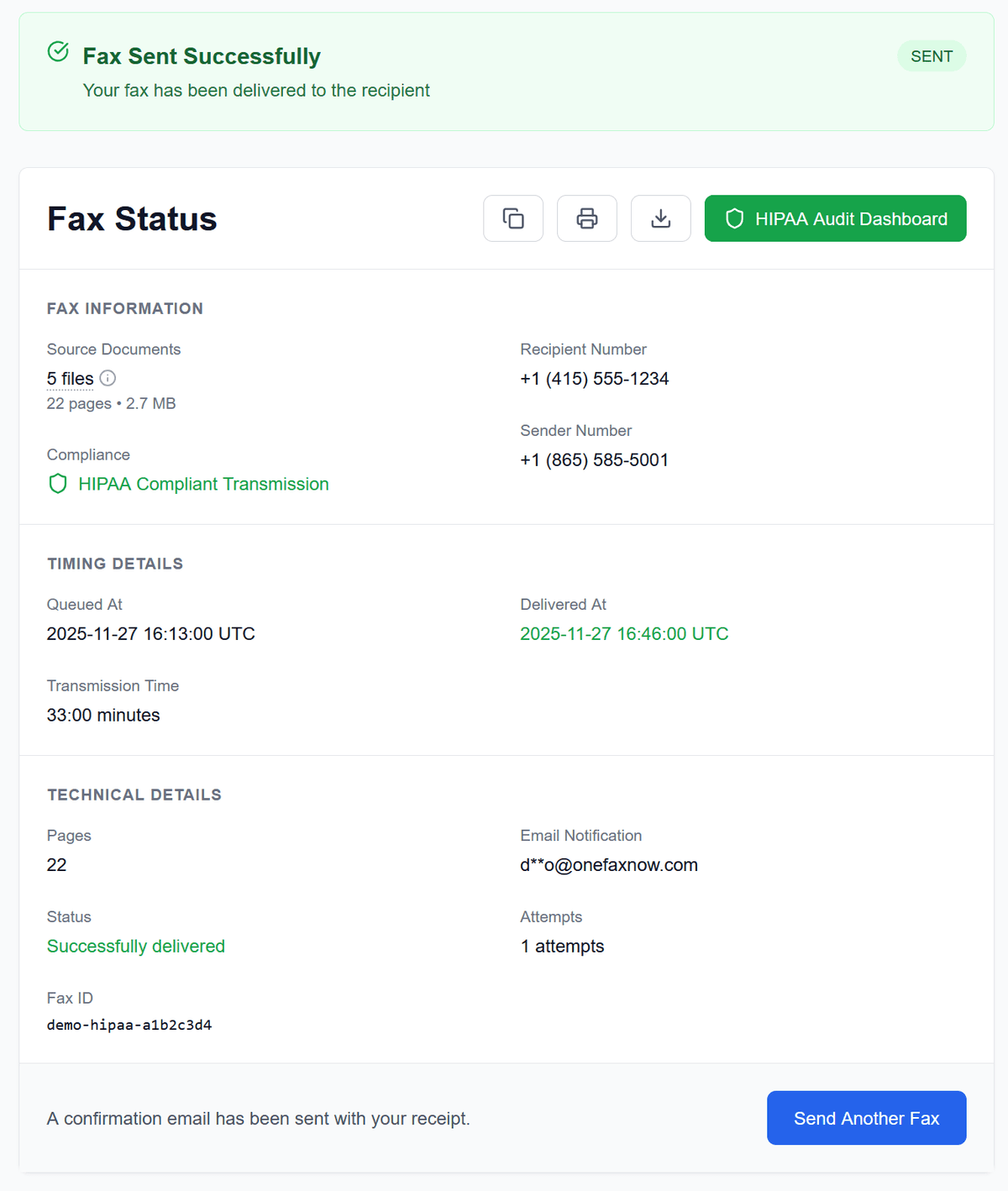

Track your fax in real time

Watch live progress on your Fax Status page. If the IRS line is busy, we retry up to 3 times. Receive email confirmation when delivered. Keep your confirmation as proof.

Why Use OneFaxNow for IRS Faxes?

No account or subscription

Send a one-time IRS fax without creating an account. No monthly plans, no recurring charges. Perfect for occasional tax document submissions.

Pay only on successful delivery

Your card is authorized at checkout. If delivery fails after all retries, you are never charged. Zero risk when IRS fax lines are congested.

Real-time tracking & email confirmation

See each step of the fax transmission in real time. Receive an email confirmation when your IRS document is delivered. Keep this as proof.

Automatic retries for busy lines

IRS fax lines can be notoriously busy, especially during tax season. OneFaxNow automatically retries up to 3 times. You can follow each attempt on your status page.

Secure handling of tax documents

Documents are transmitted over encrypted channels. Files are deleted after successful delivery. The IRS prefers fax over email for security reasons.

Meet tight IRS deadlines

Fax arrives in minutes vs 4+ weeks by mail. Critical for 30-day audit responses, S-Corp election deadlines, and time-sensitive IRS correspondence.

Simple Pay-Per-Fax Pricing for IRS Documents

Most IRS forms fit into our standard pricing tiers.

Lite IRS Fax

1–10 pages

Ideal for single-page forms like SS-4, 2848, or 8821

Standard IRS Fax

11–50 pages

For longer forms and supporting documentation

- U.S. & Canada fax numbers only

- Cover page counts toward total page count

- Pay only on successful delivery

IRS Tax Fax Questions

Can I fax my Form 1040 tax return to the IRS?

No. The IRS does not accept Form 1040 tax returns by fax. Tax returns must be filed electronically (e-file) or by mail. However, many other IRS forms CAN be faxed, including Form SS-4, Form 2848, Form 8821, Form 2553, and supporting documents for audits.

Which IRS forms can I fax?

Common faxable forms include: Form SS-4 (EIN application), Form 2848 (Power of Attorney), Form 8821 (Tax Information Authorization), Form 2553 (S-Corp Election), Form 4506-T (Transcript Request), Form 8023 (Section 338 Elections), and Form 8806 (which is fax-only). You can also fax supporting documents when responding to IRS correspondence or audits.

How do I find the correct IRS fax number for my form?

IRS fax numbers vary by form type and your geographic location. Always check the official form instructions at IRS.gov for the current fax number. Numbers can change, so verify before sending.

How long does it take the IRS to process a faxed form?

Processing times vary: Form SS-4 (EIN) takes about 4 business days by fax vs 4 weeks by mail. Form 2848/8821 takes 3–5 business days. Form 2553 (S-Corp) determination takes up to 60 days. Form 4506-T transcript requests take about 10 business days.

Does the IRS confirm receipt of my faxed documents?

The IRS typically does not provide fax confirmation. Keep your OneFaxNow delivery confirmation as proof of transmission. For Form SS-4, include a return fax number to receive your EIN.

Can I use a digital signature on IRS forms?

For Forms 2848 and 8821 submitted by fax or mail, the IRS requires a wet ink (handwritten) signature. Digital or electronic signatures are not accepted for these forms when faxed.

What if the IRS fax line is busy?

OneFaxNow automatically retries your fax up to 3 times if the line is busy. You can track each attempt on your Fax Status page. If all retries fail, you pay $0.

Is faxing tax documents to the IRS secure?

The IRS prefers fax over email because fax is harder to intercept. OneFaxNow uses encrypted transmission and deletes your files after successful delivery. On cover sheets, include only the last 4 digits of your SSN.

Ready to Fax Your IRS Documents?

Upload your IRS form, enter the fax number from the form instructions, and send. No fax machine, no subscription, no account required.