Insurance Dispute Paper Trail: Why Fax Receipts Still Matter

Why timestamped fax receipts remain crucial for insurance claims: they prove delivery, meet deadlines, protect PHI, and strengthen appeals.

Insurance Dispute Paper Trail: Why Fax Receipts Still Matter

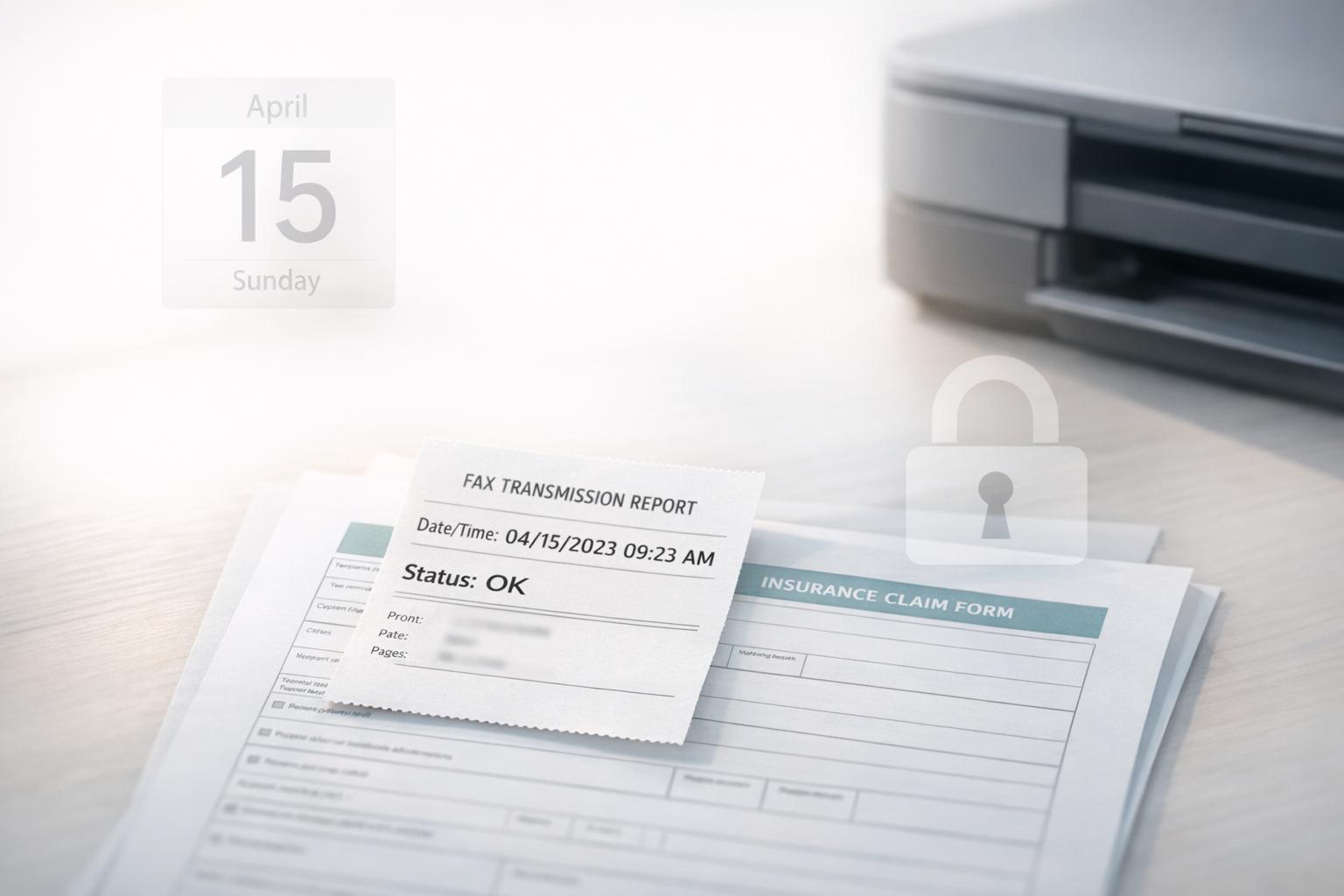

When dealing with insurance disputes, fax receipts remain a powerful tool for proving what you sent and when. Emails and verbal agreements often fall short in formal appeals, but a fax confirmation provides a timestamped, tamper-proof record that holds up under scrutiny. This is especially crucial for meeting strict deadlines, like FEMA's 180-day Proof-of-Loss requirement or a 60-day appeal window.

Key Takeaways:

- Deadlines Matter: Missing deadlines can forfeit your claim. Fax receipts provide proof of timely submissions.

- Legal Strength: Fax confirmations are verifiable and resistant to tampering, unlike emails or verbal agreements.

- Government-Preferred: Agencies like FEMA still accept faxes for claims and appeals (e.g., 1-800-827-8112).

- Practical Use: Faxing is ideal for critical documents like Proof-of-Loss forms, appeal letters, and medical records.

For occasional faxes, services like OneFaxNow offer a pay-per-fax model starting at $3.50 for 1–10 pages, with HIPAA-compliant options for sensitive documents. Faxing ensures your claim is backed by a solid, timestamped paper trail, making it easier to challenge denied claims or inadequate settlements.

What a Paper Trail Means in Insurance Disputes

Definition and Purpose of a Paper Trail

In the world of insurance, a paper trail refers to a detailed, authenticated record of every communication, photo, estimate, and document connected to your claim [3]. This includes email threads, fax confirmations, and official claim forms, all backed by timestamps. Essentially, it’s your proof of every action taken during the claims process.

Why does this matter? Because it turns your actions into facts that can’t be disputed. If an insurer says they never received your appeal letter or questions when you reported damage, a well-maintained paper trail clears up any confusion. The metadata in digital records can transform a subjective argument into hard evidence [3][4]. Since insurance claims often come with strict deadlines, having a verifiable paper trail is critical to safeguarding your rights and ensuring you’re prepared for any disputes [5].

Legal and Negotiation Uses

A solid paper trail isn’t just about keeping records - it’s your strongest tool in disputes. It validates your submissions and strengthens your position, especially when insurance companies downplay the scope of your loss. Without a documented history, challenging their findings becomes nearly impossible [4]. As Pearson Legal, P.C. explains: "The outcome of your claim will depend largely on your ability to prove your losses. Even when the cause of loss is known... none of that matters unless you can prove it" [4].

A complete paper trail doesn’t just help prove your claim - it shows you’re acting in good faith. This can push insurers to reconsider their conclusions and shield you from accusations of fraud. Real-world examples show how timestamped records can quickly resolve disputes with insurance companies or even inquiries from the Department of Insurance [3].

Ultimately, whether you’re negotiating or in court, the side with the most credible, well-documented evidence usually wins [3]. Your paper trail is more than just a collection of records - it’s the foundation of your case.

Why Fax Receipts Beat Verbal Promises

Timestamped and Reproducible Records

When it comes to insurance disputes, having concrete proof often outweighs relying on memory. Fax receipts provide a timestamp that verifies exactly when your documents were sent. This timestamp can be crucial if an insurer later claims they didn’t receive your submission or questions whether you met a deadline outlined in your policy.

Unlike verbal promises or phone conversations, fax confirmations create a reproducible record. Verbal agreements are prone to misunderstandings or misremembering, while a fax receipt includes the date, time, and page count - offering a solid reference point that’s hard to contest.

Faxes also bring an added layer of reliability. They’re resistant to tampering, making them a more secure way to document what you’ve sent [8]. This is one reason federal agencies like FEMA still accept faxed insurance documents through their dedicated fax line (1-800-827-8112) for submissions like settlement or denial letters [2]. Compared to the unpredictability of verbal agreements or email, fax receipts provide a dependable and secure record.

Fax vs. Email and Verbal Agreements

Fax receipts don’t just offer reliability - they surpass other communication methods when disputes arise. For instance, verbal agreements depend on memory, which can be unreliable, and emails, while somewhat verifiable, don’t offer the same level of certainty [8].

Fax receipts, on the other hand, are considered the gold standard for proof of delivery. They provide undeniable evidence that holds up in legal situations. Using phone lines and advanced encryption methods like 256-bit AES and TLS, fax transmissions also reduce the risk of data being intercepted [7]. This kind of secure and objective proof is indispensable when deadlines or compliance issues are on the line.

For claims with strict deadlines, fax confirmations are especially critical [5]. If an insurer challenges whether you met a deadline, your fax receipt provides undeniable proof. As Faxination highlights:

"Unlike emails, faxes cannot be tampered with, providing a legal record of transmission and receipt of documents" [8].

This makes fax receipts an essential tool for ensuring compliance and protecting your rights in insurance disputes.

Common Insurance Claim Scenarios That Require Fax

Sending Proof-of-Loss Forms

A Proof-of-Loss form is a key document that outlines the details of your loss and helps determine your insurer's liability. It’s a critical step in the claims process, as it establishes how much your insurer may cover. Keeping a documented paper trail is essential, and faxing this form ensures you have a timestamped receipt to prove submission deadlines were met[6].

For National Flood Insurance Program (NFIP) policyholders, the timeline is particularly strict - you have 180 days from the date of loss to submit your Proof-of-Loss form[1]. Faxing provides a reliable way to meet this requirement, as it offers proof of submission with a clear date and time stamp.

The California Department of Insurance emphasizes the importance of detailed documentation:

"The more information you provide about your loss, the sooner your claim can be settled"[6].

When faxing your Proof-of-Loss, it’s common to include supporting materials such as photos, receipts, or repair estimates. This ensures everything is documented and received in one package.

For disaster-related claims, FEMA provides a dedicated fax line (1-800-827-8112) to process insurance settlements, denial letters, and proof of non-insurance[2]. This method can expedite disaster assistance applications. Faxing is also invaluable when submitting appeals or additional documents, as it guarantees a verifiable record of submission.

Submitting Appeal Letters and Supporting Documents

If your claim is denied or underpaid, you generally have 60 days to file an appeal. Faxing your appeal packet ensures you have timestamped proof that it was submitted on time[1]. This is especially important for meeting strict deadlines and maintaining a clear paper trail.

Appeal packets often include extensive documentation, such as medical records, police reports, photos, and other evidence. These files can exceed the size limits of many online portals, making faxing a practical alternative. Plus, faxing provides a confirmation receipt to verify delivery[9][7].

Some commonly faxed documents during appeals include:

- Medical treatment records for auto or workers' compensation claims

- Employer statements for disability claims

- Police reports for auto claims

For health insurance claims, standardized billing forms like the UB04 (Institutional) and CMS1500 (Professional) are frequently faxed to facilitate adjudication[10].

Handling sensitive information, such as Protected Health Information (PHI), requires extra precautions. Using a HIPAA-compliant fax service ensures secure transmission. OneFaxNow offers a HIPAA mode starting at $6.50 for 1–10 pages, which includes encrypted transmission, instant BAA (Business Associate Agreement) execution, and audit logs. For less sensitive documents, their standard pay-per-fax option ($3.50 for 1–10 pages, $5.00 for 11–50 pages) provides real-time tracking and email confirmations[9]. For more details, visit OneFaxNow Insurance Claims.

Best Practices for Faxing Insurance Documents

Always Include Claim Numbers and Clear Cover Pages

When sending insurance documents via fax, it's essential to establish a clear identity for your paperwork. A claim number acts as your case's unique identifier - without it, your fax could be delayed or misdirected. Griff Harris, CIC of Griffith E. Harris Insurance Services, emphasizes:

"A claim number is a unique identification code assigned to each insurance claim. This number is pivotal in managing and tracking insurance claims, ensuring both the insurer and the insured stay updated on the claim's status and progress" [15].

A well-organized cover page can also prevent unnecessary delays. Be sure to include these key details: the policyholder's name and address, policy and claim numbers, and the date, time, and location of the loss [5][1]. Clearly label the document's purpose - whether it's an "Appeal Letter", "Supplemental Claim", or "Proof of Loss Form" - so the recipient knows exactly what to expect [1]. Adding an inventory of attached documents, such as photos, repair estimates, or witness statements, helps the adjuster confirm that everything has been received [1]. Before sending, double-check the fax number using an approved directory or by calling to verify it [12][14].

If you're sending medical-related insurance documents, include a HIPAA-compliant disclaimer on the cover page. This disclaimer should provide instructions on what to do if the fax is sent to the wrong number [16].

Save Fax Confirmations and Emails as PDFs

The California Department of Insurance offers this advice:

"Keep a log of all phone calls and correspondence, and make copies of all correspondence you send to, or receive from, your insurance company" [6].

Make it a habit to save every fax confirmation and related email as a PDF. PDFs are secure, professional, and cannot be easily altered, making them ideal for attaching to future communications [7][13]. Organize these files by claim number for quick access, especially during inquiries from the Department of Insurance or in legal situations [3]. Storing these records in a cloud-based system ensures they’re safe from physical damage and accessible anytime [12][13].

Don’t forget to review the "success" confirmation page before closing your browser. This timestamped receipt is proof that your documents were received by the carrier and can be critical if you need to meet specific deadlines [14]. By following these steps, you can create a solid, reliable paper trail that strengthens your claim and ensures your faxed documents are both organized and effective in supporting your case.

sbb-itb-0df24da

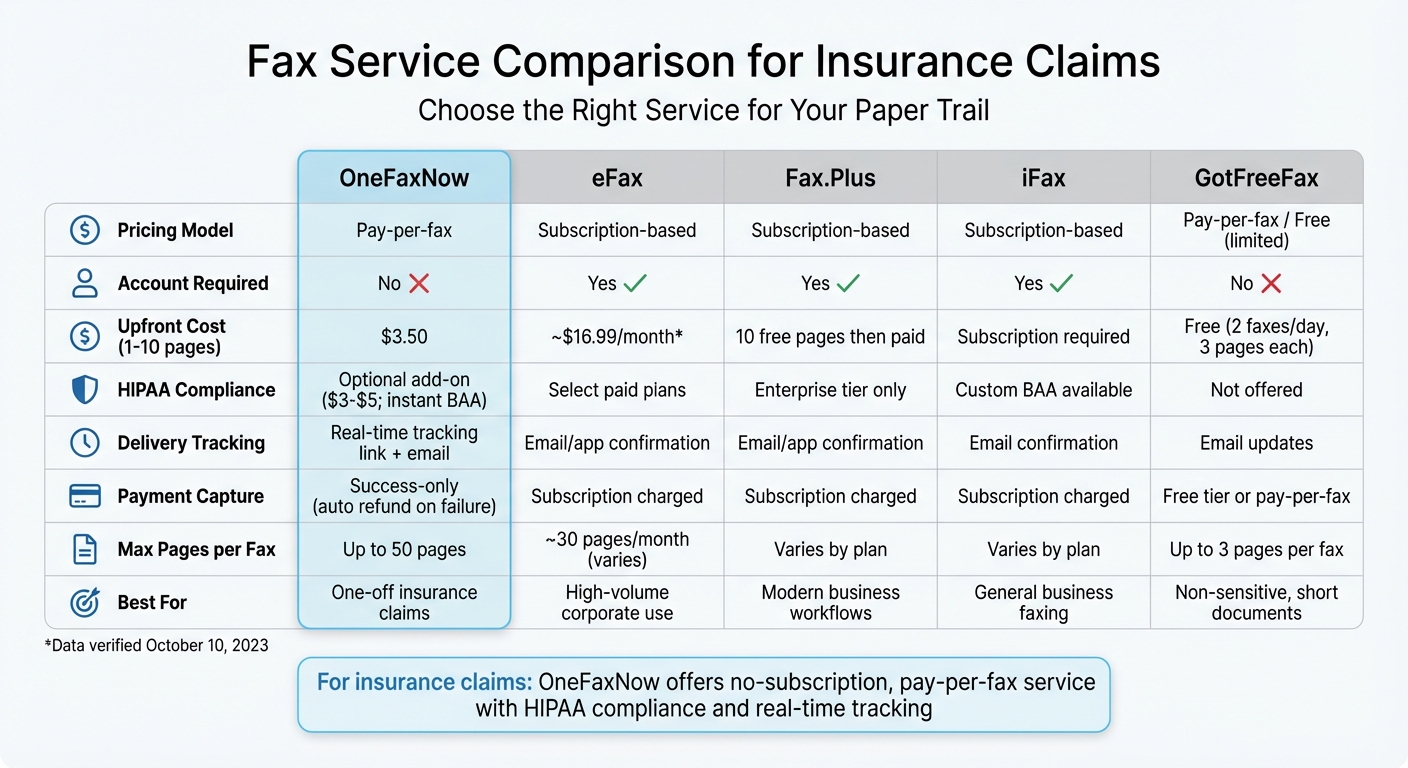

OneFaxNow vs Other Fax Services: Feature Comparison

OneFaxNow vs Other Fax Services for Insurance Claims Comparison

Comparison Table: OneFaxNow vs eFax, Fax.Plus, iFax, and Others

When it comes to maintaining a reliable insurance paper trail, selecting the right fax service is essential. Traditional services like eFax and Fax.Plus rely on monthly subscriptions and require users to create accounts upfront[11]. This setup can be inconvenient, especially if you only need to send a few documents, such as an appeal letter or supporting evidence.

The table below breaks down key features, showing why OneFaxNow is a strong choice for handling critical insurance claims:

| Feature | OneFaxNow | eFax | Fax.Plus | iFax | GotFreeFax |

|---|---|---|---|---|---|

| Pricing Model | Pay-per-fax | Subscription-based | Subscription-based | Subscription-based | Pay-per-fax / Free (limited) |

| Account Required | No | Yes | Yes | Yes | No |

| Upfront Cost (1–10 pages) | $3.50 | Approximately $16.99/month* | 10 free pages then paid | Subscription required | Free (2 faxes/day, 3 pages each) |

| HIPAA Compliance | Optional add-on ($3–$5; instant BAA available) | Available on select paid plans | Enterprise tier only | Available with custom BAA | Not offered |

| Delivery Tracking | Real-time tracking link and email | Email/app confirmation | Email/app confirmation | Email confirmation | Email updates |

| Payment Capture | Charges only upon successful transmission, with automatic refunds on failure | Charged on subscription | Charged on subscription | Charged on subscription | Free tier or pay-per-fax |

| Max Pages per Fax | Up to 50 pages | Varies by plan (often ~30 pages/month) | Varies by plan | Varies by plan | Up to 3 pages per fax |

| Best For | One-off insurance claims | High-volume corporate use | Modern business workflows | General business faxing | Non-sensitive, short documents |

*Data sourced from official pricing pages.

Last verified: October 10, 2023

Every feature in this comparison directly supports the insurance dispute process. Timestamped delivery tracking ensures deadlines are met, success-only payment capture guarantees fair charges, and HIPAA compliance safeguards sensitive medical documents.

Why OneFaxNow Works Best for Insurance Claims

Insurance disputes often boil down to sending just one or two critical documents - a proof-of-loss form, an appeal letter, or additional paperwork. Paying for a monthly subscription when you only need to send a 15-page fax doesn’t make sense. OneFaxNow's pay-per-fax model solves this problem, offering straightforward pricing: $3.50 for 1–10 pages and $5.00 for 11–50 pages. There are no recurring fees, no account setup requirements, and no need to enter credit card details for a trial[11].

OneFaxNow also provides real-time tracking and email confirmations, so you’ll know immediately when your fax is delivered. If the transmission fails, the system retries up to three times and only charges you if the fax is successfully sent. This is especially important for time-sensitive submissions, like the 180-day deadline for NFIP proof-of-loss forms[1].

For policyholders, attorneys, or anyone managing insurance claims, OneFaxNow offers a no-hassle solution. It combines transparency, compliance, and cost-efficiency, making it an ideal choice for creating an audit-ready paper trail. Whether you need HIPAA-compliant faxing or a simple pay-per-fax service, OneFaxNow is ready to support your claims process. Learn more about their insurance claim solutions or explore their pay-per-fax option.

How OneFaxNow Helps Build Your Insurance Paper Trail

Creating a solid paper trail is crucial in insurance claims, and OneFaxNow makes this process easier with real-time tracking, HIPAA-compliant features, and a pay-per-fax pricing model designed to save you money.

Real-Time Tracking and Delivery Confirmation

Each fax you send through OneFaxNow comes with a tracking link and an email update. The moment your document is delivered, you’ll receive a timestamped confirmation. This feature is particularly helpful for meeting tight deadlines, such as FEMA's proof-of-loss requirements, which can be faxed to 1-800-827-8112.

If the receiving line is busy, the system will retry up to three times. Should the fax fail after all attempts, you won’t be charged. To ensure accuracy, a SHA-256 document hash is included in the audit log, confirming that the exact file you uploaded is the one received by the insurer.

This level of tracking ensures your documents are delivered securely and on time, even when dealing with sensitive information.

HIPAA-Compliant Faxing with Instant BAA

When your claim involves Protected Health Information (PHI) - like medical records or treatment details - OneFaxNow’s HIPAA Mode ensures compliance. Simply activate it at checkout, and a Business Associate Agreement (BAA) is instantly generated and signed electronically.

"A comprehensive paper trail is the foundation upon which a successful Long-Term Disability claim is built." - Benjamin Law Firm [18]

HIPAA Mode includes TLS encryption during transmission, encrypts data while stored, and automatically deletes PHI after delivery. It also logs every step of the process for up to seven years. The HIPAA Audit Dashboard allows you to export timestamped logs as CSV or PDF files, making it easy to maintain detailed records. Pricing for HIPAA Mode is $6.50 for 1–10 pages and $10.00 for 11–50 pages.

This combination of security, compliance, and tracking makes OneFaxNow a reliable choice for handling sensitive insurance claim documents.

Pay-Per-Fax Pricing with No Subscription

Insurance claims often come in waves - you might send a proof-of-loss form today, an appeal letter months later, and nothing else for a while. That’s why OneFaxNow uses a pay-per-fax model, so you only pay when you need to send something. Pricing is straightforward: $3.50 for 1–10 pages and $5.00 for 11–50 pages. There are no monthly fees, no setup costs, and no subscriptions to cancel after your case is resolved.

"In the world of personal injury claims, what's documented is what's remembered in court. Don't let an insurance company's refusal to communicate in writing undermine your legitimate claim." - Ryan Orsatti Law [17]

You can send up to 50 pages (across 15 files, with a maximum total size of 20 MB) merged into one packet. Whether it’s a single-page cover letter or an extensive bundle of medical records, OneFaxNow adapts to your needs without locking you into a subscription plan. For more details, check out their insurance claim solutions or explore the pay-per-fax option.

Conclusion

When dealing with an insurance dispute, having solid proof of what you sent - and when - can make or break your claim. Fax receipts offer timestamped, tamper-proof evidence that verbal agreements simply can't provide. This kind of documentation is essential, especially as insurance companies grow more wary of claims without proper records [4]. A reliable paper trail isn't just helpful - it's your strongest defense.

OneFaxNow simplifies this process with features like real-time tracking links, instant email confirmations, and HIPAA-compliant options through a Business Associate Agreement (BAA). Whether you're submitting a proof-of-loss form to meet a strict 60-day deadline [5] or sending medical records to FEMA at 1-800-827-8112 [2], OneFaxNow ensures your documents are delivered on time and intact. Unlike traditional subscription services, this platform offers a more efficient and user-friendly solution.

What sets OneFaxNow apart is its pay-per-fax pricing model. At $3.50 for 1–10 pages and $5.00 for 11–50 pages, you only pay when you need to fax - no setup fees, cancellation penalties, or hidden charges. This on-demand service is a cost-effective alternative to subscription-based options, giving you flexibility without unnecessary commitments.

Send a Fax Online - No Account Required

Need HIPAA compliance? Learn about HIPAA Faxing

FAQs

Why are fax receipts considered more reliable than email confirmations in insurance disputes?

Fax receipts are often considered more dependable than email confirmations in insurance disputes because they provide a timestamped and verifiable transmission record. While emails can sometimes be intercepted, altered, or delayed by spam filters, fax confirmations clearly demonstrate that the document was successfully sent and received by the intended recipient.

This reliability makes fax receipts especially important for critical insurance tasks like submitting proof-of-loss forms, appeal letters, or supporting documents. They create a reproducible, tamper-resistant trail that can serve as solid evidence during negotiations or disputes, helping ensure transparency and accountability throughout the process.

How does OneFaxNow protect sensitive documents and ensure HIPAA compliance?

OneFaxNow prioritizes HIPAA compliance by providing an optional HIPAA mode specifically tailored for securely managing sensitive documents. This mode incorporates enhanced privacy protocols, the ability to instantly execute and download a Business Associate Agreement (BAA), and tools designed to support audits.

With features like real-time status tracking, automatic retries, and success-only delivery confirmation, OneFaxNow ensures that your documents are sent both securely and reliably. These capabilities make it a dependable option for transmitting protected health information (PHI) while adhering to HIPAA requirements.

What are the benefits of using a pay-per-fax service for insurance claims?

Using a pay-per-fax service for insurance claims comes with some standout advantages, especially when it comes to maintaining a solid paper trail. These services provide timestamped proof of transmission, which is essential for documenting exactly when critical claim documents - like proof-of-loss forms or appeals - are sent. This can help prevent disputes and strengthen your position during negotiations with insurers.

Another perk? Pay-per-fax services are budget-friendly for occasional use. Since there’s no need for a subscription or recurring fees, you only pay when you actually send a fax. Many platforms also include helpful features such as email confirmations, delivery status updates, and PDF copies of fax receipts, so you’ll always have clear, reproducible records for your files. Plus, they often comply with standards like HIPAA, offering a secure way to handle sensitive claim information.

With straightforward pricing, support for multiple file types, and quick delivery, pay-per-fax services streamline the claims process. They help reduce the risk of delays or lost paperwork, making them a practical tool for policyholders, attorneys, and advocates dealing with insurance disputes.